Cashing In On Clouds and Spirits: The Economic Underpinnings of Regulating Hookah, Cigarettes, and Alcohol

Share

The Fiscal Factors: Taxation and Economics in Regulating Hookah, Cigarettes, and Alcohol

The realm of taxation and economic interests casts a long shadow on the regulation of consumables like hookah, cigarettes, and alcohol. Unraveling this intricate tapestry provides insights into the policy-making dynamics and priorities.

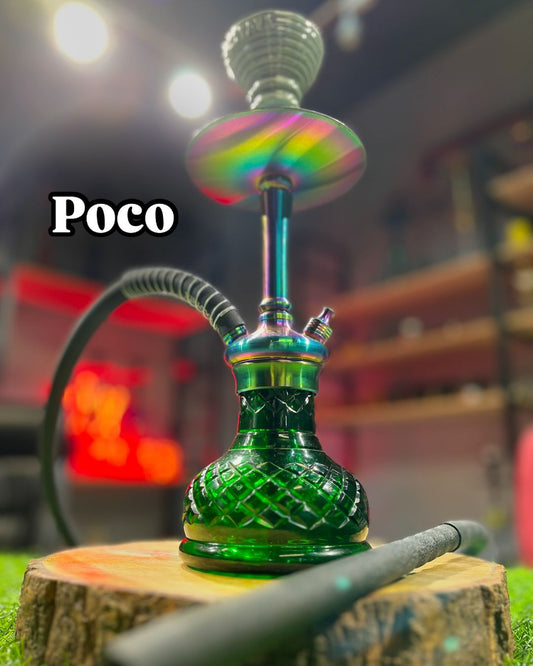

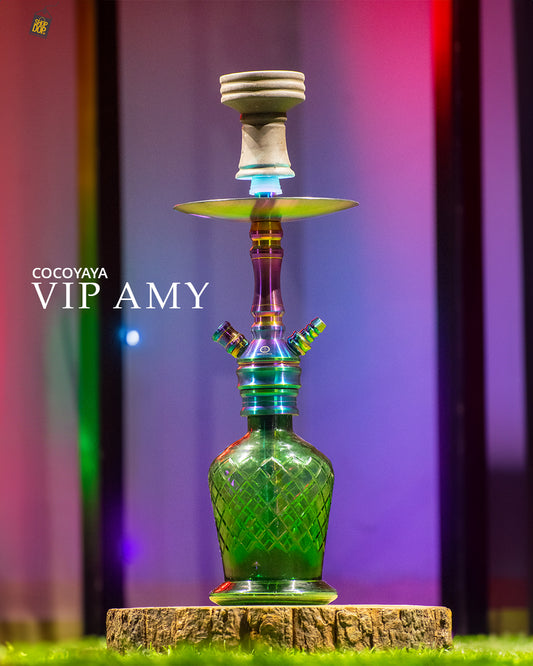

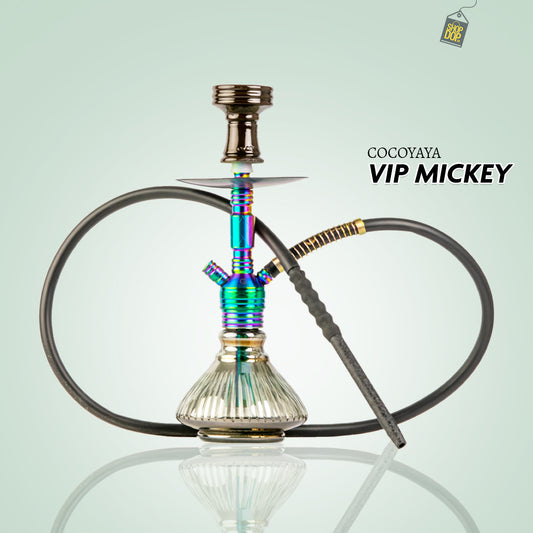

Hookah: A Newcomer in the Tax Net

While hookah has ancient roots, its global commercial rise is relatively recent. As its popularity soared, governments saw a potential revenue source. Taxing hookah products, from tobacco to equipment, not only bolsters state coffers but can also serve as a deterrent to consumption, mirroring tactics used for other tobacco products.

Cigarettes: The Golden Goose of Excise Duties

Cigarettes have long been a lucrative tax source for governments. High excise duties serve a dual purpose: providing substantial revenues and discouraging smoking due to health concerns. However, this tightrope walk is challenging, as excessive taxation can fuel illegal markets, reducing potential tax earnings and posing public health risks.

Alcohol: Economics and Social Considerations

Alcohol taxation is a complex interplay of revenue generation and societal considerations. Distinct tax rates for different alcoholic beverages can reflect economic priorities, cultural values, or health concerns. Moreover, monopolies in alcohol distribution and sales in some regions make it a direct revenue stream for governments.

Economic Interests and Lobbying

The production and sale of hookah, cigarettes, and alcohol involve powerful industries. Their economic interests, including job creation and export potential, can influence regulatory decisions. Lobbying efforts by these industries can sometimes sway policies in their favor or against competitors, underlining the importance of vigilant public health advocacy.

Conclusion

Regulation of hookah, cigarettes, and alcohol isn't solely a health debate; it's also an economic one. The tug-of-war between revenue generation, industry interests, and public health concerns will continually shape the regulatory landscape of these products.